hotel tax calculator nc

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Gross receipts derived from the rental of an accommodation and the sales and use tax thereon are to be reported to the Department on Form E-500.

Arizona Sales Tax Small Business Guide Truic

That rate applies to taxable income which is.

. Use our lodging tax lookup tool to get a rate report specific to your North Carolina rentals address. Im not sure about that particular hotel but the last time I stayed in Raleigh in November 10 I had to pay NC sales tax 775 Occupancy tax 3 and city tax 3. Please enter the following information to view an estimated property tax.

Avalara automates lodging sales and use tax compliance for your hospitality business. The calculator should not. The North Carolina Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income.

North Carolina has a 475 statewide sales tax rate. Bladen County NC Sales Tax Rate. Avery County NC Sales Tax Rate.

Usually the vendor collects the sales tax from the consumer as the consumer makes a. Skip to main content Menu. Just enter the five-digit.

Hourly non-exempt employees must be paid time and a. 7 state sales tax plus 1 state hotel tax 8 if renting a whole house. So if the room costs 169 before tax at a rate of 0055 your hotel.

A the individual holds a valid Personal Tax Exemption Card that allows for the relief of such taxes. For tax year 2021 all taxpayers pay a flat rate of 525. Avalara automates lodging sales and use tax compliance for your hospitality business.

Ad Finding hotel tax by state then manually filing is time consuming. North Carolina Salary Calculator for 2022. This calculator is designed to estimate the county vehicle property tax for your vehicle.

Our North Carolina Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. 7 state sales tax plus 6 state hotel tax 13 if renting a hotel or room. The report includes the estimated total tax rate to collect from guests number of.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Answer 1 of 2. North Carolina moved to a flat income tax beginning with tax year 2014.

Minimum Wage in North Carolina in 2021. Total General State Local and Transit Rates Tax Rates Effective 1012020 Historical Total General State Local and Transit Rate Tax Rates Tax Charts. Our calculator has recently been updated to include both the latest Federal.

Ad Finding hotel tax by state then manually filing is time consuming. OFM considers personal lodging expenses to be exempt from taxation when. This North Carolina hourly paycheck.

Bertie County NC Sales Tax Rate. Rentals of Hotel Rooms and. The act went into full effect in 2014 but before then North Carolina had.

In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. Beaufort County NC Sales Tax Rate. It is my understanding that in Raleigh lodging rooms are taxed at 135 475 state sales tax 225 county sales tax 6 county occupancy tax.

You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202122. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

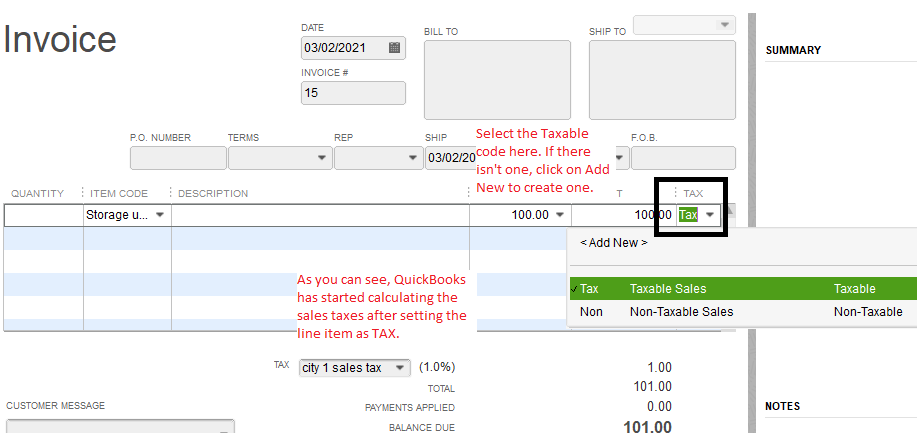

Solved How Do You Add Tax To Estimates And Invoices

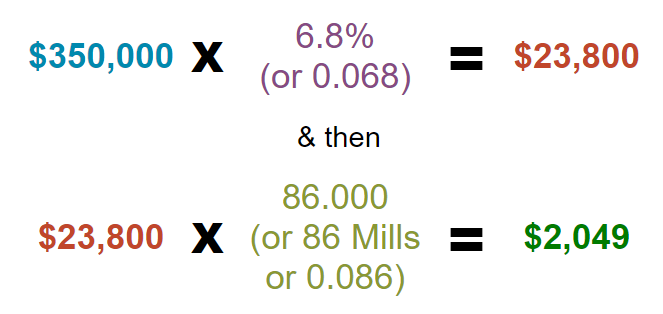

Property Tax Calculation Boulder County

Fha Changes May Tighten Credit For Homebuyers Realestateagent Firsttimehomebuyer Massachusetts Massachusetts Association Of Buyer Agents Investing Financial Management Financial

Florida Income Tax Calculator Smartasset

Hawaii Income Tax Hi State Tax Calculator Community Tax

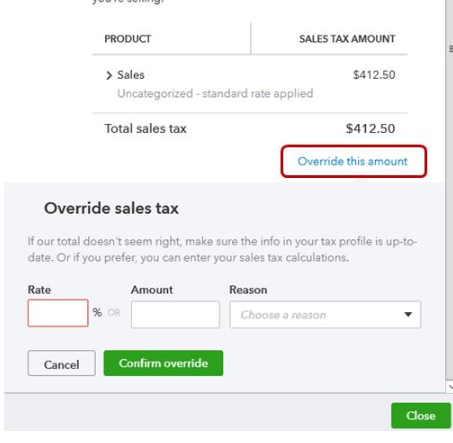

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

States With Highest And Lowest Sales Tax Rates

Taxfyle Com Tax Bracket Calculator Income Tax Brackets Tax Brackets Income Tax

Property Tax Calculation Boulder County

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

California Tax Calculator State Basic Facts Tax Relief Center Basic Facts Tax California

Tax Calculator Gambling Winnings Free To Use All States

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

Spanish Property Taxes For Non Residents

The Independent Contractor Tax Rate Breaking It Down Benzinga

Marginal Tax Rate Formula Definition Investinganswers

Income Tax Calculation 2019 इनकम ट क स Calculate करन क सबस आस न तर क 2019 20 Youtube